By Chris Berry

- With the commodity super cycle changing its complexion and looking for direction, we continue to believe that the metals markets don't have the "wind at their backs" anymore.

- It has been surprising to see many metals prices either bottom or shoot higher in the face of a slowing China and a sluggish global economy haunted by the specter of deflation.

- Can this upward bias in select metals prices continue given this backdrop?

- We continue to argue for SELECTIVITY amongst metals and companies as a crucial component of your investment selection until the next leg up of the cycle begins.

We're Still at a Bottom…But for How Long?

After enduring two terrible years in the metals markets, it has been a welcome respite to see several key metals either bottom or start to trend higher in 2014. I discussed the Q1 performance of many of these metals in a previous note you can read here.

What makes this performance particularly confounding is that the gains are being made in the face of a global economy that is showing a mixed bag with respect to growth. For much of the past decade, many investors (ourselves included) focused on emerging markets as the lynchpin of economic growth with the developed world growing more slowly.

While the emerging world still offers the most optimal long-term investment proposition (as we have argued before), this paradigm seems to have shifted now somewhat with developed world growth accelerating and the emerging and frontier markets generally slowing, though each case is different.

North America, and the US in particular, stands to benefit from two key excesses - energy (thanks to hydraulic fracking) and labor (thanks to huge slack in the labor market). The excess in labor is a major factor in keeping wage growth stagnant - good for employers, but bad for workers. The Euro Zone has shown recent signs of emerging from an economic slumber, though deflation is still a key concern (as it is in the US). Japan, also having struggled with deflation for years, has recently shown signs of inflation picking up thanks to the policies of Abenomics. It remains to be seen whether the gains in the Euro Zone and Japan can be sustained, and therefore the US would appear to be the best positioned major economy going forward.

Given this backdrop, one could argue that the global economy appears in better shape than it has in some time (though admittedly that isn't saying much). A look at the performance of several metals in the futures markets would seem to indicate that we have either bottomed or are in the early stages of a rebound.

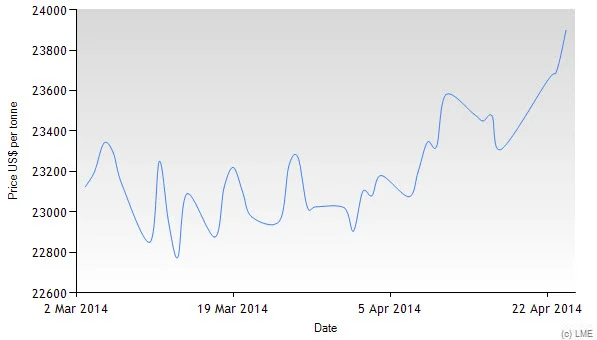

One of my current favorites is Tin:

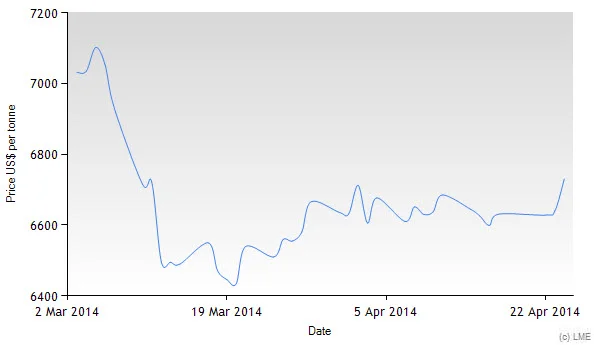

The futures market here is still solidly in backwardation indicating market participants want tin - now. I've written in the past on tin and you can read the most recent note here. This metal's real outperformance is due to the announcement in January by the Indonesian government to halt all exports of select metal ores. Tin is but one of a number of metals affected by this new law. Nickel has also proven to be a major beneficiary of this government interference and has hogged the spotlight somewhat:

If Copper really is the metal with a PhD in economics, then the recent upturn in prices is a positive sign:

Recent pronouncements from the Freeport McMoRan (FCX:NYSE) Q1 2014 earnings conference call last week lead me to believe that copper remains in a tight market and the bottom is most definitely in here. When earnings season concludes, I'll be writing a note on the overall take of company CEOs about the economy, their markets, and forward-looking prospects.

One metal I am paying more attention to these days is Zinc. Looming mine closures, a lack of near-term supply, and steady demand are what have me looking more closely at macro data and companies that stand to benefit. Teck Resources' (TCK:NYSE) announcement to reopen its Pend Oreille underground mine in the US and Trevali Mining Corp's (TV:TSX, TREVF:OTCBB) announcement to reopen its Caribou mine are but two examples of miners feeling bullish on zinc's future.

Cobalt, one of the most crucial components in lithium ion batteries, is choppy recently, but I still think deserves your attention as the fact that it is mined mainly as a byproduct in less-savory parts of the world could lead to near-term opportunities.

Finally, Molybdenum seems to have awoken from its slumber:

To be fair, I am only looking at a small set of metals and there are some, uranium in particular, which have proven to be major disappointments and tell a somewhat different story. Also, some of the metals listed above are relatively small markets, but all the metals shown above have at least one similarity - according the futures data, they have either bottomed or are showing recent strength. Additionally fertilizers and soft commodities such as coffee, corn, and soybeans are all off to very impressive starts in 2014.

This is significant in the face of emerging market growth that is decidedly slowing. News of trust defaults in China, over capacity in infrastructure, and the threat the People's Bank of China (PBoC) will export deflation through currency manipulation are all valid concerns.

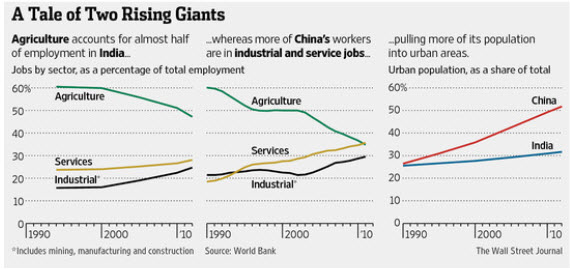

Falling yields in infrastructure also indicate that China's leaders must not waste any time in instituting economic reforms towards increased individual consumption:

These are but a handful of concerns that China's leaders must face. Others include shadow banking and loosely managed credit growth, environmental damage, territorial issues, and job creation. However serious these issues are, viewed in the broad context of convergence of lifestyles, the growth picture and strategy to capitalize on it is still very much intact.

I include the chart above as a reminder of the potential that not just China and India hold for growth going forward, but the entire emerging world together. As an aside, McKinsey has written a short book which lists six major trends the consultancy believes will drive China's growth going forward. They are listed below.

Takeaway and Answer to the Original Question

The original point of this note was to look at some evidence and decide whether or not metals had decoupled from China. If there were a direct linear relationship between metals performance and Chinese GDP growth, then the metals should have continued to stagnate or fall rather than show the relative strength they have. They generally have not stagnated, though metals share prices by and large have. This could be due to a number of factors aside from sluggish growth including the tapering of asset purchases, but it is still too early to tell. The decoupling I hypothesized above can't be confirmed yet, but it is worth continuing to watch metals performance against the backdrop of slower economic growth in the emerging world.

The dis-inflationary or potentially deflationary forces in the global economy have me continuing to urge caution in the metals and specifically in the junior mining space. The sector is still too big, with too many participants with no hope of realistic financial salvation. The wake of the global financial crisis left behind a surplus; a surplus of workers, of capital, and of capacity. This, more than anything is why I am currently more focused on dis-inflationary forces rather than the opposite.

My overall strategy and approach to the metals markets has not changed. Your selectivity at this stage of the cycle is imperative. I still think uranium, cobalt, tin, fertilizers, and silver are preferable. I think gold has more downside to it and would favor silver relative to gold due to its industrial applications. As I mentioned above, I'll be looking more closely at zinc soon.

I am still heavily biased towards near-term production of a handful of metals or minerals. This bias translates to an 90% weighting in a metals portfolio with the remaining 10% devoted towards true discovery stories. It is these discovery stories which can provide more leverage to share price appreciation in more a more favorable market than the one we now find ourselves in. The focus on production offers a hedge until a more favorable market environment returns.

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at the Disruptive Discoveries Journal make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note. I own no shares in any company mentioned in this note.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. For a more detailed disclaimer, please see the disclaimer on our website.