- Tesla Motors (TSLA:NYSE) recent announcement to build its own vertically integrated lithium ion battery factory (dubbed the Gigafactory) sent the share prices of many junior mining companies into the stratosphere

- There are a number of questions to consider behind TSLA’s strategy, but with respect to the junior mining sector, one wonders if this is a lifeline or a false dawn

- Though lithium and graphite plays have benefited the most from the TSLA announcement, there are a host of metals which will be required to manufacture the specific battery chemistry

- It was interesting to note that cobalt or nickel plays didn’t react in the same way lithium plays did after the announcement

- It is dangerous for a junior mining company (or an investor) to assume that a major manufacturer like TSLA will rely on a junior not yet in production to feed the eventual Gigafactory supply chain

- The success or failure of the Gigafactory rests less with a secure supply of raw materials and more with the long term price of a gallon of gas

An Exciting Development in the Energy Metals Space

Though I’ve never written about it, TSLA is a clear example of a Discovery Investment. The company continues to succeed and prove the naysayers wrong at every turn. TSLA CEO Elon Musk has so far been able to demonstrate that vehicle electrification can become a reality, even if this is only currently attainable for a small segment of society. I have driven a Model S and can confirm that much of what you read in the press is true – this is a beautiful automobile and I can see this type of technology and transportation succeeding on a mass scale subject to lower battery costs in the future.

One of the keys to the company’s success has been its ability to vertically integrate and design the car from the power train up. The recent announcement of the Gigafactory, where the company will manufacture its own lithium ion batteries, should really be a surprise to no one. Successful vertical integration will help lower costs and add to margin expansion for the company and its shareholders.

When the news of the Gigafactory was announced, this included specifying that the factory would be located in Nevada, Arizona, New Mexico, or Texas. This sent share prices of many North American-based junior explorers and developers of lithium straight up, giving them the shot in the arm they are so desperate for.

This is all very exciting, and a welcome development, for an Energy Metals sector that has by and large been in the doldrums in recent months.

Questions To Consider

The Gigafactory is no small feat. The cost is rumored to be close to $5 billion and by 2020 will be able to produce 500,000 lithium ion batteries – more than were produced globally in 2013. TSLA has stated that they are:

“…planning to build a large scale factory that will allow us to achieve economies of scale and minimize costs through innovative manufacturing, reduction of logistics waste, optimization of co-located processes and reduced overhead.”

The need to vertically integrate and drive down costs also becomes clear when you consider that TSLA was responsible for consumption of roughly one third of global lithium ion cells produced in 2013 – equating to 1,750 MWh. Clearly the company must become more self-reliant if it intends to achieve its goals with the Gigafactory by 2020.

Shown below is 2013 global lithium ion battery production and TSLA’s plan. TSLA has stated they will provide $2 billion of the cost of the factory with other manufacturers including Panasonic and Sanyo rumored to be contributing as well.

TSLA’s ability to drive down the cost of the battery on a kWh basis will be crucial to its success.

This leads to one of the main questions here. Specifically, who will TSLA partner with to not just build and finance the factory, but supply the raw materials necessary for its batteries?

I said above that the share prices of certain lithium, graphite, and rare earth plays in North America went parabolic on the Gigafactory announcement. This is always a dangerous sign. While any higher share price is a welcome development in this tough market environment, it is likely short-lived.

Who Really Benefits from the Gigafactory?

Not all junior mining companies are created equal and in the case of the Gigafactory, some metals/minerals are more crucial than others. With the specs for lithium ion batteries varying from one chemistry to the next, this also adds another layer of complexity.

Given TSLA’s pronouncements to locate the Gigafactory in the Western US, Rockwood Holdings (ROC:NYSE), a favorite company of mine in the lithium space, would appear to be a natural fit. The company is producing lithium in Nevada and is the number one producer of lithium compounds in the world. This offers a substantially de-risked partner for TSLA.

This is not to say that a select junior couldn’t integrate into TSLA’s supply chain, but given the risks associated with junior mining today and the fact that the lithium market is an oligopoly with excess capacity, making a bet on a junior partnering with TSLA seems like a long shot.

There is a decidedly different story when looking at possibilities with other metals or minerals. The Tesla Model S uses a specialized Nickel Cobalt Aluminum (NCA) cathode chemistry from Panasonic. For all the discussion of lithium as a critical component of lithium ion batteries (something I don’t disagree with), it was most surprising to me to see the share prices of cobalt and nickel plays stand pat in the face of the Gigafactory announcement.

I have written often about the rise of Resource Nationalism in countries such as Indonesia and the Democratic Republic of the Congo and many of you who follow the production of cobalt and nickel know that these countries produce a majority of world supply of these metals respectively.

With the Indonesian government banning exports of raw ore of select metals, this has, predictably, put upward pressure on the price. Specifically, nickel (as traded on the LME) is up roughly 9% year to date and cobalt is up 5% (with higher grade material having recently hit two year highs of roughly $15 per lb).

The typical lithium ion battery requires anywhere from 6 to 9 kg of cobalt, so simple math implies that an additional 4,500 tonnes of refined cobalt ((9 * 500,000)/1,000) will be needed just to satisfy demand from the Gigafactory. To put this in perspective, roughly 75,000 tonnes of refined cobalt was produced in 2012.

This additional demand ignores other battery manufacturer growth plans as well as growing demand for cobalt in other applications. Industry experts have forecast cobalt demand growth at 7% p.a. going forward. Cobalt offers an interesting case study in a critical and strategic metal set to see an increase in demand (with or without TSLA) and a somewhat uncertain supply picture thanks to geopolitics.

So while cobalt stands to be a critical piece of the puzzle going forward, there is another big winner in the move to vehicle electrification:

Graphite.

Of the numerous materials needed to manufacture a lithium-ion battery, graphite is the largest component (but not the most expensive).

Just as we did with cobalt, if we make some assumptions on current flake graphite usage in batteries, a clear picture emerges around additional graphite demand.

First, we assume that TSLA will use natural graphite in the annode of its batteries. If the goal of the Gigafactory is to cut the cost of the battery in half, then natural flake graphite, with its lower overall cost profile relative to synthetic graphite, must be the material of choice.

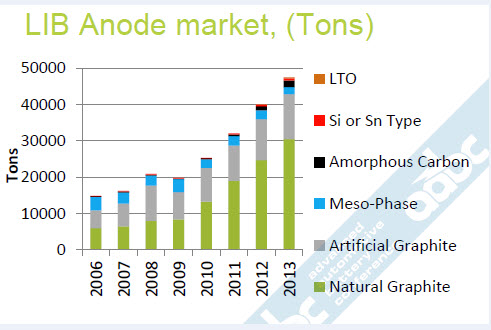

Above, we see the graphite usage in the lithium ion battery market up through 2013. Annode production in 2013 was roughly 47,000 tons of carbon materials, with 30,000 tons coming from natural graphite. The end goal is to produce coated spherical graphite and industry sources have told me that it takes three tons of natural graphite to produce one ton of spherical graphite.

The typical EV battery uses 56 kg of spherical graphite, so if TSLA is to produce 500,000 EV batteries by 2020, this would imply demand of 28,000 tons of spherical graphite just for the Gigafactory ((56*500,000)/1000).

If three tons of natural graphite are required to produce one ton of spherical graphite, an additional 84,000 tons of natural flake graphite would need to be supplied per year on world markets. (28,000*3)

Simon Moores of Industrial Minerals (who has done superlative work on this topic) estimates that there was 375,000 tonnes of flake graphite production worldwide in 2013, with only 20% of this total (75,000 t) suitable for lithium ion batteries, not to mention other uses like refractories. Competition for this material should support healthy graphite pricing going forward.

So a picture emerges where TSLA must source 112% of today’s global production of natural flake graphite to make the Gigafactory a success by 2020. This has breathed new life into the junior mining graphite sector – and rightfully so.

Threats and A Reality Check

I am as hopeful as anyone that TSLA can achieve its goals here as it would translate into a great success story and, incidentally, benefit select junior mining companies.

Discretion is the better part of valor, however, and there are a number of threats here which cannot be ignored or dismissed.

To begin with, TSLA’s expansion plans are massive. With a lack of secure supply of some critical materials including cobalt and graphite, hindered access to these materials at a reasonable cost could do serious harm to TSLA’s plan to cut the cost of its batteries in half. TSLA must find materials in reliable and predictable geopolitical jurisdictions which will integrate into their value chain and help achieve economies of scale.

Second, though electric vehicles have the spotlight, there are a number of competing technologies which could, in the future, render electric vehicle technology somewhat obsolete including hydrogen fuel cell vehicles (from Toyota), synthetic fuel vehicles (from Audi), natural gas powered vehicles, and higher CAFE standards here in the United States. There is also a great deal of time and money being invested in battery technology worldwide which could possibly render current battery chemistries like NCA obsolete. This is a long shot, to be sure, but cannot be completely disregarded.

Other issues including an overvalued share price and multiple lawsuits concerning TSLA selling cars in the United States directly to consumers are other issues to be aware of, but are not necessarily germane to the success or failure of the Gigafactory. The decision by the state legislature in New Jersey yesterday to ban the sales of Tesla automobiles in the state is an unfortunate reminder.

TSLA has been an amazing success story to date and has been able to produce a product that people are willing to pay a premium price for. As someone who has driven a Model S, I understand and even share in the enthusiasm.

For as far as TSLA has come in recent years, the company still has a long way to go. As an example, TSLA sold as many cars in 2013 (22,477) as General Motors roughly sold in a single day (GM sold 9.71 million cars in 2013 according to Bloomberg).

It is this wide gap that makes Elon Musk’s expansion plans so exciting and daunting at the same time. There are a multitude of factors which will ultimately determine the success or failure of the Gigafactory, but it is clear that reliable supply of various Energy Metals remains at the heart of this strategy.

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at Morning Notes make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. For a more detailed disclaimer, please go to http://house-mountain.com/disclaimer/.