By Chris Berry

Late last year, I highlighted phosphate as one of the critical natural resources we will focus on in 2014

- The phosphate story is the story of security of supply because much of global phosphate supply originates from geopolitically unstable regions of the world

- The key to success is secure access to low cost phosphate rock. Supply of this resource will become increasingly constrained if current consumption trends continue into the future

A Long Term Play on Food Security

With net global population set to rise due to an emerging middle class and shrinking arable farm land, a closer investment look at agricultural efficiencies and fertilizers is warranted. The essential need for fertilizers in ensuring the healthy growth of crops is not a secret, but the fertilizer story seems to have been lost in the broader critical minerals story. Many entities, NGOs, investment banks, and think tanks are projecting a global population of between 9 and 9.5 billion inhabitants by 2050. This is a 30% increase from just over 7 billion today.

Shrinking arable farm land complicates the food picture. New agricultural technology has the potential to increase production from arable land, however the projected rate of increase in global population will very likely outpace increase in the amount of available arable land.

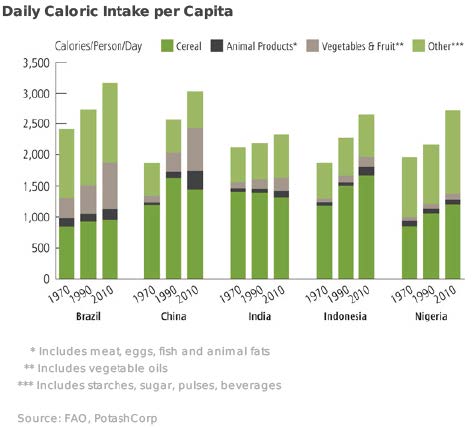

Accompanying this shift is a change in the typical emerging middle class diet, again driven by the rising quality of life in developing markets:

Most market participants see no discernible sign of these demographic trends abating. This lays the foundation for a more complete analysis and understanding of supply and demand in the fertilizer space.

The Different Types of Fertilizers

Broadly speaking, fertilizers are broken down into three nutrients – Nitrogen, Phosphate (or phosphorous) and Potassium. Each nutrient provides unique benefits for healthy agricultural production. Demand for each forecast to grow at different rates (1.5%, 2.3%, and 3.7%) per year respectively. This can be compared to the long run (50 year) CAGR of fertilizer consumption of 3.6%.

Today we focus on phosphate which complements our previous research on potash supply and demand.

In addition to the long-term demand drivers for fertilizers mentioned above, adverse weather (global warming) and increased biofuels usage (ethanol) are other factors altering the supply and demand balance.

As governments of developing economies attempt to ensure their rapidly growing populations have higher quality nourishment, it is evident that access to quality phosphate rock is an important security of supply story.

Phosphate Specifics

Hard rock phosphate is the primary source for several different fertilizers. These are:

- Mono-ammonium phosphate (MAP)

- Di-ammonium phosphate (DAP)

- Triple-superphosphate (TSP)

- Superphosphate (SSP)

Phosphate ore is typically mined and processed into fertilizer. MAP and DAP are the most common of these. Phosphoric acid is also produced during processing. Additionally, phosphate ore may be processed into various uses such as for animal feed and other human applications, but these account for a minority of uses (less than 15%).

Once the ore is mined, it is then dissolved in acids (phosphoric and sulfuric) to produce additional phosphoric acid. This phosphoric acid is combined with ammonia and granulated to produce MAP and DAP. Additional chemical processes produce different types of phosphate-based fertilizers.

The several types of phosphate fertilizers differ based on their percentage of contained P2O5. It is also important to remember that phosphate, like many other minerals, is non-renewable or recyclable. Many in the industry have stated that there is no substitute, so as the emerging global middle class explodes in the coming decades, market disruptions will create significant opportunities – one of the main reasons fertilizers deserve your investment consideration for further study.

A flow diagram demonstrates the process described above.

Potash Corp (POT:NYSE, POT:TSX) has estimated that 50% of global food production is due to fertilizer usage with the other 50% the result of factors including irrigation, planting density, and cultivation practices.

Global Mined Phosphate Production and Trends

According to the USGS, phosphate is mined in the following countries:

The U.S., China, Russia and countries in Western Africa account for the bulk of supply. However, this is likely to change as environmental laws tighten in the U.S., mining becomes more expensive in China, and political instability in countries like Western Sahara and Morocco remains a significant risk. With respect to China, we believe more mineral production will stay “on-shore” to feed the populace.

It is important to remember that the recent uprisings which began in Northern Africa and subsequently spread throughout much of the Middle East (termed the Arab Spring) began in Morocco mostly as a result of higher food prices amongst other issues.

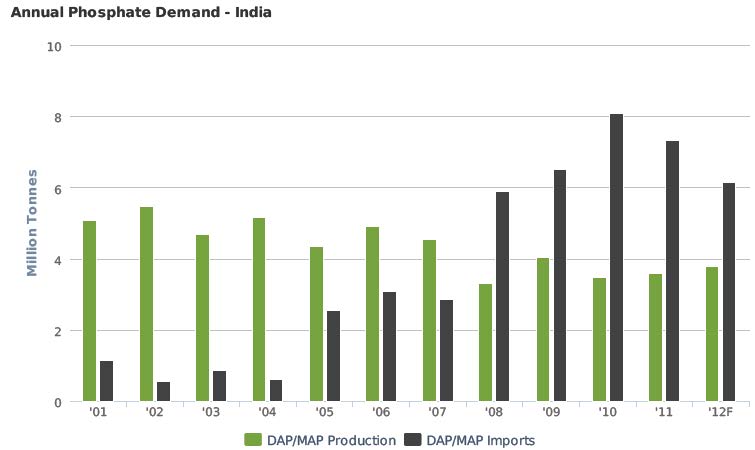

I stated above that phosphate rock demand was forecast to grow at roughly 2.3% per year to 2017. This equates to approximately an additional 5 million tonnes of additional supply needed per year. Currently China and India comprise the bulk of phosphate (DAP/MAP) demand. The trends in their phosphate production, consumption, and imports are below:

It is evident that there is sufficient phosphate supply. Inabilities to secure phosphate rock at an economic price from a stable jurisdiction are the key issues.

The major phosphate and potash producers (shown below) are attempting to integrate vertically to capture additional margin along the value chain, making accessing “cheap rock” a must.

Who are the Players?

Courtesy of Mosaic (MOS:NYSE, M:TSX) , the largest combined phosphate and potash producers:

Source: Mosaic Corporate Presentation

OCP is based in Morocco and is one of the few pure phosphate plays in the space. OCP produced roughly 27 million tonnes (~13%) of global phosphate rock in 2012 with plans to double this production in coming years. As OCP is an operation that is vertically integrated, not all of this 27 million tonnes is exported. Other phosphate producers such as Phosagro (PHOR:MCX) have announced similar expansion plans. The markets will pay a premium on those phosphate rock deposits that offer attractive economics and the ability to integrate into existing supply chains in the coming years.

Pricing Dynamics

Phosphate fertilizer is priced based off the price for phosphate rock. The current benchmark is the Morocco/North Africa export price and it is Morocco where the price is typically set. Like many other metals or minerals, the higher the grade, the more valuable the rock. The Morocco/North Africa rock concentrate price is based on a ~30-32% P2O5 and is currently at ~$100 per tonne.

As stated before, phosphate rock is used in the production of phosphate fertilizers (MAP, DAP, etc). It is the fertilizers which command a higher price. Many of the producers of phosphate fertilizer own and operate their own mines and thus are vertically integrated. This is a trend that is forecast to continue, but as phosphate is a non-renewable resource, it stands to reason that phosphate rock miners will be on the lookout for economic deposits of phosphate to replace mined tonnes.

Conclusion

To reiterate, there is no current issue with a lack of supply of phosphate (either mined or in the ground). Demand is forecast to increase by roughly 2.3% year into the foreseeable future. The increased supply necessary to meet this demand is dependent upon a host of disparate factors. The potential opportunity arises when one connects several looming issues that, when put together, warrant further study of the fertilizer business; specifically phosphate.

These include:

- The quality of life dynamic we have discussed so frequently with increasing populations living longer lives and eating a more protein-based diet in the face of decreasing arable farm land.

- A majority of the phosphate rock produced originates in parts of the world where geopolitical instability or resource nationalism is rife. This puts a premium on security of supply.

- Mining costs are increasing throughout the world, putting a premium on potential low-cost deposits.

- The major phosphate producers have made commitments to increase production in coming years, but this is to integrate into existing downstream supply chains. This infers less raw phosphate rock for export.

- Less raw phosphate rock for export should put a premium on those undeveloped deposits that offer the most attractive economic profiles.

- Though major producers outside of the US have made public pronouncements of capacity expansion, this trend is forecast to reverse in the United States.

We will discuss Arianne Phosphate Inc (DAN:TSXV, DRSSF:OTCBB), a company positioning itself to exploit the points listed above shortly.

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at Morning Notes make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. I own shares in DRSSF and am an advisor to the company.