By Chris Berry (https://twitter.com/cberry1)

Ed Note: **This piece is a shorter version of a book I am writing on the economic, financial, and geopolitical aspects of the energy transition and will publish in 2020.

What a difference a year makes. The Summer of 2018 can arguably be remembered as a time when investor sentiment for lithium and cobalt took a turn for the worse. Since then a paradox in the sector has only become more glaring: while prices for lithium and cobalt in various forms have continued to fall, long term demand projections haven’t budged and are still very much intact. This disconnect has caused many investors to leave the sector for the “safety” of index funds or cash.

While it’s true that spodumene originating from Western Australia has flooded the market as I believed it would, pushing lithium prices down, conversion capacity in China remains somewhat of a question mark. How much is existing? What is the spare capacity? How much is under construction? When will a new equilibrium be reached?

As someone who has been to China recently, these questions have answers that change more frequently than you’d like to believe. Once built, scaled, and fine-tuned, investor logic dictates that this will push prices for lithium carbonate and lithium hydroxide down further. While some sell side banks might agree here, the truth is, as always, somewhere in between.

Much the same can be said for cobalt which has a truly ugly chart (below). The recent decision by Glencore to put Mutanda, a truly world class copper/cobalt asset, on care and maintenance for the foreseeable future due to poor economics says volumes about resource nationalism and royalties hurting profitability (to put it mildly), but still says nothing about long-term demand for cobalt, which appears firmly intact.

Source: Bloomberg

Not to be outdone, rare earths are back in the news as an increasingly assertive China has made not-so-subtle threats around weaponizing its supply of rare earths as the country’s supply chain dominance remains, much to the chagrin of the national defense apparatus in Washington DC and other Western capitals. President Xi’s recent photo op at a rare earth magnet manufacturing facility and the implicit threat of “don’t say we didn’t warn you” have focused policy maker attention.

These industry-specific factors are important, however, it appears that a confluence of macro-economic and political forces are converging all at once to place investors and corporations at a unique crossroads vis-à-vis investment along the strategic metals supply chain.

In my research, drivers of the macro economy have historically either been political or economic in nature, but rarely both at the same time. While not an exhaustive list, here are some of the major drivers of overall investor sentiment in the markets today:

· An escalation of the US-China trade war which now seems likely to devolve further into a beggar-thy neighbor currency war. China now setting the Yuan below 7 per USD (chart below) is the latest (and perhaps not the last) escalation.

Source: Bloomberg

While this is more of a psychological level than anything else, it’s clear that President Xi isn’t content to give President Trump the upper hand in trade negotiations and is looking to soften the blow to an increasingly fragile Chinese economy (slowest economic growth in 27 years) through currency depreciation. This is but one way in which discount rates get raised on projects.

· $15 trillion of negative yielding debt (and counting). Why invest in the sovereign credit markets when you’re guaranteed to return less money than you initially invested, assuming you hold to maturity?

Source: Bloomberg

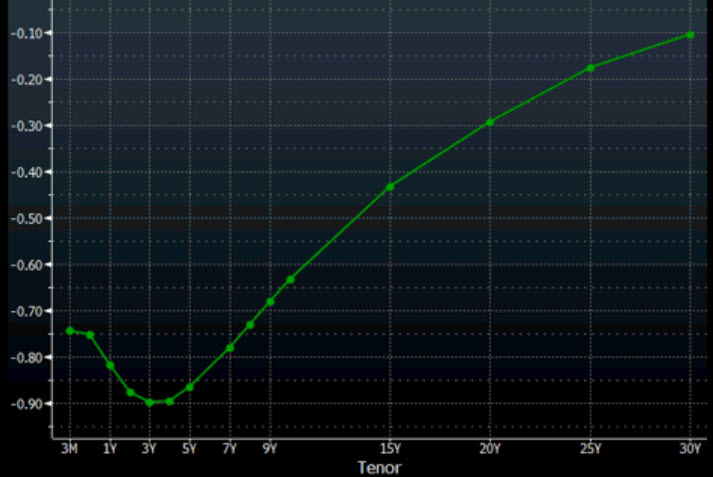

· A sickly European banking sector led by Germany. The ENTIRE yield curve in Germany is in fact in negative territory. Why can’t one of the most technologically advanced and dynamic economies in the world generate growth?

Source: Bloomberg

· Democracy protests in Hong Kong are likely the biggest and most under-reported story of all today. When will President Xi decide enough is enough and put a decisive end to the protests? Can he? Most certainly before October 1, which is the 70th anniversary of the founding of the Peoples Republic of China.

· While economic growth and low unemployment look positive in the US, much of the economic data in the rest of the world has many economists wringing their hands over the timing of a possible recession.

Source: Bloomberg

I think the US 10 Year yield collapse to below 1.7% (shown above) is arguably the most important chart in the world now as it signifies a risk off mentality and does not augur well for Central Banks looking to stimulate economic growth through monetary policy vis-à-vis lower interest rates. Can negative rates in the United States become a reality?

· Tension between India and Pakistan (two nuclear armed countries) over the annexation of the disputed region of Kashmir.

· Other considerations include a no-deal Brexit, tensions between Japan and South Korea, the flow of oil in the Strait of Hormuz, North Korea missile launches, and the US Presidential election in 2020.

While each of these points likely requires their own separate piece to properly delve into and understand the implications, it’s clear that a convergence of economic and geopolitical factors are spooking investors and delaying capital expenditure decisions on the part of corporates. There is an increasing body of evidence that shows positive share price performance in recent quarter is due to share buybacks (thanks to low borrowing rates) rather than organic growth through increased capital expenditure. How sustainable is this? One wonders whether Albemarle’s recent announcement to shelve production plans for an additional 125,000 tonnes LCE was sparked as much by these macro headwinds as it was the desire to “grow” with the market.

To be fair, this doom and gloom does mask some very positive longer-term dynamics around the energy metals/EV thesis including the fact that oil demand growth is slowing, and EV sales, despite a recent small dip in China, are continuing their strong growth trajectory. When viewed through a longer-term investment horizon lens, it is very difficult to justify a long-term bearish thesis here. However, one thing is clear, supply chains are changing as we speak and this is perhaps the crisis and opportunity.

DE-GLOBALIZATION AS A FORCE FOR GOOD?

The emergent macro view of de-globalization spurred in large part by President Trump’s tariffs assault and backing away from existing global trade architecture arguably couldn’t come at a better time for the lithium ion battery sector. As I have said before, there isn’t a playbook supply chain managers or participants can refer to in order to project how to allocate capital efficiently and optimally. This realization has dawned on investors and most of the hedge funds I work with are content to take more of a “wait and see” approach regarding equity investing. This is quite frankly the most prudent and unsurprising realization of the past year.

With lithium and cobalt pricing range bound in my opinion for the next 18 months, a lack of volatility means most momentum players (e.g. hedge funds) are not actively investing while more “patient capital” such as pension funds, insurance companies, or value investors are worried about the historical boom and bust cycle while desperately searching for yield in a low growth-low yield global economy.

The paradox in all of this is that the dismantling of the existing global trading system and its eventual replacement is exactly what you’d want to see as an investor along the strategic metals supply chain. Technological supremacy (5G, Artificial Intelligence, drones, battery technology, materials science) and deflationary forces (specifically cost deflation) are creating a unique opportunity for project-level investment that could not come at a better time. The industry is clearly starved for capital and while it’s true that assets can get cheaper, the requirement for funding to electrify transport is needed now – not in 2025 or beyond. Any significant delay in capital allocation here almost assures a delay in more widespread EV uptake.

In other words, investment in this sector requires more patience than most growth investors are likely accustomed to given the historic volatility associated with violent raw materials price swings. This patience is one way in which China (and Asia writ large) has come to dominate multiple aspects of the supply chain as technology and specialty chemicals investments are not typical value (read: patient) investment opportunities.

Whether this dominance is set to continue isn’t really the most important question, but given the upheaval in the macro economy and national security implications, there likely hasn’t been a better time for patient long-term investors to seriously think about participating in this unprecedented transition around the electrification of transportation and energy storage. The societal, economic, and national security implications are simply too significant to ignore. The time for strategic thinking on the parts of Western governments, corporations, and other stakeholders is now as the inevitable price parabola has run its course here.