By Mike Berry

In July 2008, then Treasury Secretary Henry Paulson touched off the greatest banking crisis of our generation stretching back to the 1930’s. On Sunday, July 20th 2008 before the markets opened in Asia, the Treasury Secretary of the United States stepped in to guarantee the US bond portfolio owned by China. Earlier that same day he had commented on national TV,

“I think it's going to be months that we're working our way through this period, clearly months. Of course the list [of difficulties] is going to grow longer given the stresses we have in the marketplace, given the housing correction - but again, it's a safe banking system, a sound banking system. Our regulators are on top of it. This is a very manageable situation.”

We have now spent 72 months - or 6 years - in the economic malaise that followed the US housing bubble’s implosion. The entire banking system of the free world teetered.

The graph below shows one impact of the greatest global monetary contraction of modern times. The M1 Money Multiplier statistic dropped within four months when the extent of global bankruptcy risk to the financial system began to be discounted into the world’s capital and money markets. This was an unprecedented event in economic history.

Source: St. Louis Federal Reserve

The Money Multiplier is the statistic that relates the relative health of our vaunted fractional banking system. It reveals how effectively the US base money supply is being multiplied into the money supply in circulation, a critical measure of the health of the US economy.

Since November of 2008, the multiplier has been indicating an ineffective banking system. Milton Friedman once blamed this Multiplier’s demise as one cause of the Great Depression. He expressed his view that the Federal Reserve had not increased the money supply quickly enough. The then Vice Chairman Bernanke responded, in a tribute to Dr. Friedman, that the Federal Reserve was responsible for the Great Depression but would not make that mistake again.

The ultimate Keynesian irony is that this “remedy” has not mattered today, an outcome neither Dr. Friedman nor Dr. Bernanke would have believed. Through the Fed’s actions, we avoided a catastrophic banking melt down, but the US economy is now employment, inflation, and real personal income impaired.

In the interim we have experienced several Quantitative Easing programs including the most recent incarnation QE3, which the Federal Reserve under Chairwoman Yellen, is now “tapering.”

No matter how much paper currency is printed, the banking system’s fractional machinery remains mute. The domestic money supply is static and the European money supply is declining. The M1 Multiplier shown above through August 6, 2014 may have bottomed. However it shows no sign that a sustainable economic recovery is underway. Could it be the several hundred trillion dollar derivative tsunami is forcing bankers to lay funds with the Federal Reserve rather than the consumer?

Inflation?

We might have seen an explosion in prices when this long dormant multiplier broke to the upside. It has been 6 years of a certain “New Normal.” How much real structural industrial reorganization, re training and disruptive discovery must our leaders in Washington initiate? Who will lead? How long must the American populace suffer with ineffective economic and fiscal policies?

One notable side effect of the Federal Reserve “printing” programs has been the massive increase in size of its SOMA portfolio. As of August 20, 2014 the portfolio had grown from $600 billion to $4.14 trillion. The Federal Reserve has been purchasing Agency and Treasury securities in an effort to suppress interest rates.

Interest rate suppression was considered critical for the housing market and economic recovery. Worldwide, overnight interest rates have been held close to zero for 6 years. Chairwoman Yellen seems to have no resolve to raise short interest rates any time soon in spite of divisions within her FOMC. As of August 29th, the 10 year Treasury bond yielded 2.336% nominally and only .22% real. Wealth is being transferred from some of the most vulnerable in society to the government. Seniors and institutional investors are paying this penalty to fund the government.

Today the Federal Reserve has become a very big player in the bond market with its $4 trillion SOMA portfolio of Treasury and Agency securities. If the Fed were to sell this portfolio down to a more sustainable level, higher interest rates would ensue. Higher rates would be anathema to this recovery. The Fed is the new BIG player in the bond market.

Velocity is another revealing story. Velocity is a statistic that measures turnover of the money supply relative to the GDP of the economy. A higher or growing velocity means that the money supply is turning over faster and the economy is healthier. The St Louis Federal Reserve defines it:

”This is a ratio of nominal GDP to a measure of the money supply (M1 or M2). It can be thought of as the rate of turnover in the money supply--that is, the number of times one dollar is used to purchase final goods and services included in GDP.”

Source: St. Louis Federal Reserve

As is apparent, the velocity has not reacted to the Fed’s policy of increasing the base money supply. In fact, almost on cue, velocity has fallen and continues to decline even after the end of the Great Recession in 2009. These results are through the first quarter of 2014.

New Normal indeed!

St. Louis Federal Reserve

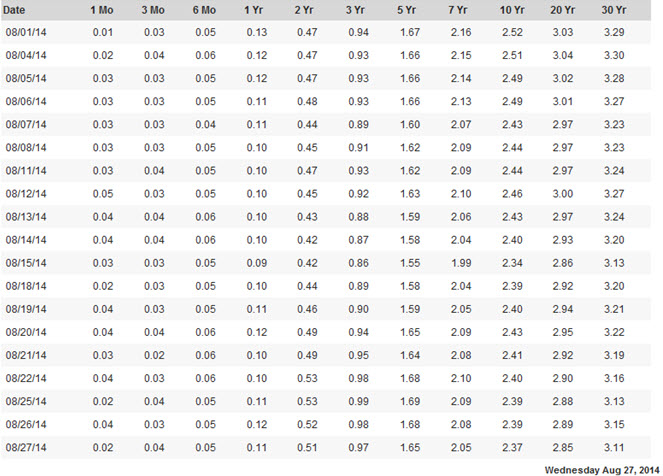

US Treasury Yield Curve as of August 27th 2014

Ever Higher

In spite of these underlying, empirical warning signs, the stock market, infused with liquidity, continues its way to “summit Everest” in oblivion. These are good days for many equity investors, at least those not in the natural resource sector. The problem is that most Americans are not serious equity investors. The wealth of this equity bubble accrues to the few and it is entirely ephemeral.

Billionaire CEO’s are being minted weekly in Silicon Valley. The irrationality of the time reminds one of other times when bubbles, ex post, were so apparent. It is the human condition to see after the fact, not before.

So we are left mired in the current state of the economy. It is a state reminiscent of Japan’s 30 year experience with the ogre of deflation, stagnant real income growth, permanently higher unemployment, an educational system that replaces labor intensive wealth creation with digital productivity.

Beware dear equity investor, beware.

Equity Markets Have Risen 60% Under the Fed’s Auspices

Source: Stockcharts.com

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at the Disruptive Discoveries Journal make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. For a more detailed disclaimer, please see the disclaimer on our website.