- No sooner had I penned a note on the state of the uranium market than news out of Japan has helped to shift sentiment in a positive direction

- In its first draft energy policy since 2011, the government of Japan has committed to maintain nuclear energy as a key source of base load power

- Uranium producers, development plays, and explorers all rocketed higher on the news, but…..

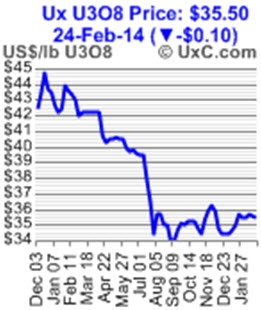

- The key metric – the price of U3O8, hasn’t moved off it its lows

- With U3O8 prices still in the dumps, my investment strategy with respect to uranium hasn’t changed – specifically, take profits on any company specific or industry specific good news

We’re Finally Getting Somewhere….

Earlier this week, the government of Japan released its Basic Energy Plan which dictates a forward looking energy policy for the country. This is reportedly the first release of the document since 2011. While the plan does point out the need to restart nuclear reactors, it also states that a “mix” of energy sources including renewable and fossil fuels will be used to meet Japanese energy demands. A key point here, which was apparently left out of the Plan, was exactly what this mix will be.

It is no secret that Japan’s 48 reactors are off line, but with 17 having applied for restart and reports of 10 of these being on line by this summer; it’s not hard to see why so many investors are reconsidering investment in uranium plays. The Wall Street Journal recently published a helpful chart showing the reactor fleet in Japan and the restart status of each. It can be found here (subscription required).

Renewables reportedly only account for 2% to 3% of Japanese power output, and with the country paying elevated prices for fossil fuels such as natural gas (approximately $15.50/MMbtu), it is clear that nuclear energy will remain a substantive part of Japanese power output for the foreseeable future – despite a queasy public.

With the release of this Plan coupled with the Economy, Trade, and Industry Minister Toshimitsu Motego publicly stating “in principle, the direction has not changed” regarding Japanese energy policy, the recent strength in uranium producers, developers, and explorers is not a surprise.

One of the most defensive plays in the uranium space, Cameco (CCJ:NYSE, CCO:TSX) has benefitted, up over 20% YTD as I write. Other favorites of mine like UR-Energy (URG:NYSE, URE, TSX) and Uranerz (URZ:NYSE, URZ:TSX) are up 37.5% and 35.15% YTD as well.

There are numerous others that have benefitted from this recent move including Energy Fuels (UUUU:NYSE, EFR:TSX), up over 90% YTD, and Denison Mines (DNN:NYSE, DML:TSX), up 37.5% YTD.

Interestingly, the strength is not limited by geography as plays as far afield in South America (U3O8 Corp (UWE:TSX, UWEFF:OTCBB) up 65% YTD and Australia have “caught a bid” and rewarded shareholders.

…But There is Still a Long Road Ahead

I have said before and continue to believe that a sustainable and healthy rally in uranium miners can really only occur on the back of higher U3O8 prices. This is the one factor now missing from what many have called a “uranium renaissance”.

The leverage a company’s shares can gain from higher commodity prices is undeniable and has been proven over time across multiple commodities. Though the term price is currently higher than the spot price, many companies involved in uranium exploration still host projects whose economics are either unworkable or unknown at current uranium prices.

The Takeaway

For this reason, my strategy and tactics regarding uranium investing still remain unchanged. Namely, selling into share price strength on discoveries or positive news for the sector as a whole. A perfect example is the recent Japanese news discussed above.

This positive sentiment, coupled with exciting discoveries in the Athabasca Basin, US-based companies that can produce uranium in the current depressed price environment, and the longer-term emerging market embrace of nuclear energy have brought us to this point.

The sector will no doubt pull back – likely soon – so taking “a little off the table” at this point seems to be the most prudent course of action.

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at Morning Notes make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. For a more detailed disclaimer, please go to http://house-mountain.com/disclaimer/. I own shares in URZ.

The leverage a company’s shares can gain from higher commodity prices is undeniable and has been proven over time across multiple commodities. Though the term price is currently higher than the spot price, many companies involved in uranium exploration still host projects whose economics are either unworkable or unknown at current uranium prices.

The Takeaway

For this reason, my strategy and tactics regarding uranium investing still remain unchanged. Namely, selling into share price strength on discoveries or positive news for the sector as a whole. A perfect example is the recent Japanese news discussed above.

This positive sentiment, coupled with exciting discoveries in the Athabasca Basin, US-based companies that can produce uranium in the current depressed price environment, and the longer-term emerging market embrace of nuclear energy have brought us to this point.

The sector will no doubt pull back – likely soon – so taking “a little off the table” at this point seems to be the most prudent course of action.